- UseTheBitcoin.com Newsletter

- Posts

- Today's Top Crypto Headlines:

Today's Top Crypto Headlines:

Bhutan Adopts Ethereum ID | Tether Settles Celsius Case | Binance Unveils $400M Relief | Paxos Burns $300T PYUSD and more...

Good Morning Crypto Enthusiasts!

Glad to have you back for another edition of the UseTheBitcoin.com newsletter.

Bhutan Adopts Ethereum ID: Bhutan has migrated its national digital ID system, covering 800,000 citizens, from Polygon to Ethereum, citing stronger decentralization and zero-knowledge privacy.

Tether Settles Celsius Dispute: Tether will pay $299.5M to the Celsius bankruptcy estate over 2022 collateral disputes. The deal, a fraction of Celsius’s $4B claim, signals growing accountability for stablecoin issuers.

Binance Launches $400M Relief: Binance unveiled a $400M relief fund to aid users hit by $19B in leveraged losses during the latest market crash.

💡Feature of the Day - Paxos Burns $300T PYUSD: Paxos accidentally minted 300 trillion PYUSD tokens before burning them 22 minutes later due to an internal error. The glitch briefly froze Aave’s PYUSD trades but caused no losses.

All this and more in today’s headlines!

Crypto’s Most Influential Event

This May 5-7 in 2026, Consensus will bring the largest crypto conference in the Americas to Miami’s electric epicenter of finance, technology, and culture.

Celebrated as ‘The Super Bowl of Blockchain’, Consensus Miami will gather 20,000 industry leaders, investors, and executives from across finance, Web3, and AI for three days of market-moving intel, meaningful connections, and accelerated business growth.

Ready to invest in what’s next? Consensus is your best bet to unlock the future, get deals done, and party with purpose. You can’t afford to miss it.

📰 News Highlights:

Bhutan has officially migrated its national digital identity system, covering nearly 800,000 citizens, from Polygon to the Ethereum blockchain. The decision marks a major leap in blockchain adoption for national infrastructure, emphasizing Ethereum’s immutability, decentralization, and privacy via zero-knowledge proofs.

1/ Today, Bhutan celebrates a historic milestone, becoming the first nation to anchor its national digital identity system on Ethereum. 🇧🇹

@VitalikButerin and I were honored to join the launch ceremony on behalf of the Ethereum community, graced by His Royal Highness.— Aya Miyaguchi (@AyaMiyagotchi)

6:09 PM • Oct 13, 2025

This is Bhutan’s third upgrade, having previously used Hyperledger Indy and Polygon. The integration was hailed by Ethereum Foundation President Aya Miyaguchi as a “world-first,” proving how smaller nations can lead in technological innovation.

2/ When I first visited Bhutan in May 2024, I felt a strong resonance between Bhutan and Ethereum: both believe that visions for the future must be grounded in strong foundational values.

It’s deeply inspiring to see a nation commit to empowering its citizens with self-sovereign— Aya Miyaguchi (@AyaMiyagotchi)

6:09 PM • Oct 13, 2025

Beyond identity modernization, Bhutan is also emerging as a crypto powerhouse. The country is now the fifth-largest government Bitcoin holder, amassing over 11,000 BTC worth $1.3 billion through sustainable mining powered by hydropower.

Ethereum 🤝 Bhutan

This is cool - Bhutan just integrated the BhutanNDI system with Ethereum.

Vitalik and Aya joined the ceremony with the Prime Minister and Crown Prince.

BhutanNDI is a private SSI system for verifiable credentials on-chain for anything citizen related 🇧🇹

— timour kosters (@timourxyz)

5:09 PM • Oct 13, 2025

The national ID transition cements Bhutan’s reputation as a blockchain-forward nation, combining clean energy, crypto investment, and decentralized infrastructure to drive a more transparent digital future.

Tether has agreed to pay $299.5 million to the Celsius Network bankruptcy estate, resolving a dispute over Bitcoin collateral liquidations from Celsius’s 2022 collapse. The settlement, facilitated by the Blockchain Recovery Investment Consortium (BRIC), represents a fraction of Celsius’s original $4 billion claim but stands as a landmark legal moment.

Tether is pleased to have reached a settlement of all issues related to the Celsius bankruptcy.

— Paolo Ardoino 🤖 (@paoloardoino)

3:06 PM • Oct 14, 2025

Celsius accused Tether of prematurely selling nearly 40,000 BTC used as collateral, worsening its insolvency. The recovery will go toward compensating Celsius’s creditors, marking a win for BRIC’s ongoing recovery mission.

The case redefines the legal perception of stablecoin issuer liability. By paying such a large sum, Tether indirectly acknowledges accountability within distressed lending markets, something stablecoin firms have long avoided.

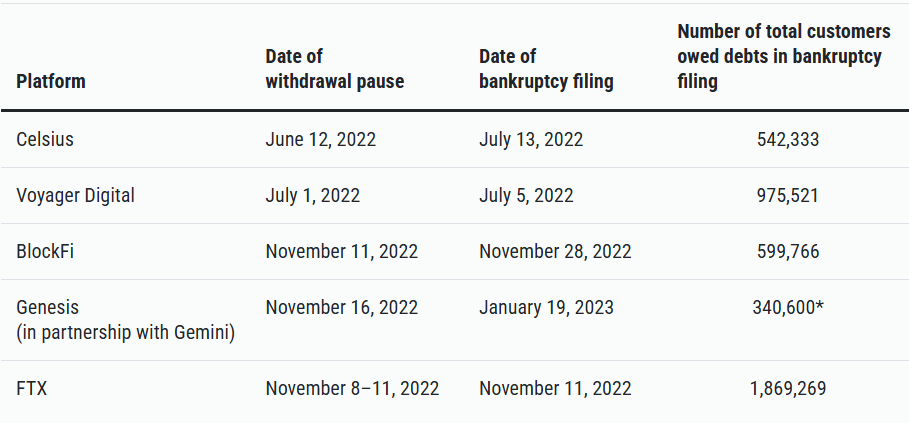

Analysts suggest this precedent could reshape future crypto bankruptcies and regulatory frameworks governing stablecoin operations. The settlement also closes one of the darkest chapters of the 2022 crypto crash that toppled Celsius, BlockFi, Voyager, and FTX.

Binance has launched a $400 million relief program to support traders hit hard by the recent market crash, which wiped out over $19 billion in leveraged positions in a single day.

💛 Binance launches the Together Initiative, a $400M recovery and confidence-rebuilding plan to support users and institutions during this volatile period.

Read more 👇

— Binance (@binance)

3:24 PM • Oct 14, 2025

The initiative includes $300 million in token vouchers and a $100 million loan fund for users whose forced liquidations exceeded 30% of their holdings between October 10–11, 2025. Binance said the program aims to “rebuild confidence,” though it denies liability for user losses tied to technical glitches during the sell-off.

Talk is cheap.

$283 million compensation on @binance

$45 million recovery airdrop on @BNBCHAIN and @four_meme_

Another $400 million recovery airdrop on @binanceProtect users.

— CZ 🔶 BNB (@cz_binance)

5:54 PM • Oct 14, 2025

The relief effort extends Binance’s total market recovery support to $728 million, including a $45 million BNB Chain airdrop for memecoin traders. While praised by some for quick action, others view it as an attempt to deflect accountability.

Strong move by Binance, confidence isn’t rebuilt through words but through action.

— Seedli Capital (@SeedliCapital)

4:10 PM • Oct 14, 2025

Still, this massive voluntary payout reinforces Binance’s role as the industry’s de facto stabilizer, setting new expectations for centralized exchanges to assist users during volatile downturns.

@binance@BNBCHAIN@four_meme_ binance’s mispriced internal price oracles are directly at fault for the $400 billion in liquidations and corresponding market crash on Friday. there is no “together” with binance. enough is enough.

everyone needs to get their funds off binance immediately.

— curb.sol (@CryptoCurb)

6:01 PM • Oct 14, 2025

💡 Feature of the Day:

Stablecoin issuer Paxos accidentally minted a staggering 300 trillion PayPal USD (PYUSD) tokens, worth over $300 trillion, before burning them 22 minutes later.

At 3:12 PM EST, Paxos mistakenly minted excess PYUSD as part of an internal transfer. Paxos immediately identified the error and burned the excess PYUSD.

This was an internal technical error. There is no security breach. Customer funds are safe. We have addressed the root

— Paxos (@Paxos)

8:53 PM • Oct 15, 2025

The incident, caused by an internal technical error, briefly alarmed the crypto community and triggered a temporary freeze on PYUSD trades by DeFi protocol Aave. Paxos quickly confirmed there was “no security breach” and that user funds were safe, noting that the issue stemmed from an internal transfer mistake.

PYUSD is operational and fully backed at a 1:1 ratio.

Earlier today, 300 trillion was minted and subsequently burned.

We've temporarily frozen PYUSD markets on @aave as we investigate the issue.

Funds are safe!

— Omer Goldberg (@omeragoldberg)

8:21 PM • Oct 15, 2025

Despite the astronomical scale of the error, PYUSD maintained its 1:1 peg to the dollar, reflecting strong system stability and a swift crisis response.

While I appreciate the transparency and the incredibly fast response to burn the excess PYUSD, the initial minting error itself is definitely concerning, given the bedrock trust required for a dollar-backed stablecoin. Glad to hear customer funds are unaffected and the root cause

— Rui Diao (@RuiDiaoX)

9:31 PM • Oct 15, 2025

The episode, though short-lived, highlights the sensitivity of blockchain ecosystems to automated minting errors and the importance of robust internal checks. Paxos’s transparency helped restore confidence within hours, avoiding potential contagion across DeFi markets.

It’s not the dollar amount you should be thinking about. It’s the fact that this is a collateralized asset that can be created without the collateral.

— VBL’s Ghost (@Sorenthek)

11:30 PM • Oct 15, 2025

😂 Crypto Meme of the Day:

Paxos intern be like: $PYUSD

— 长人工尺口 (@kairo8080)

9:13 PM • Oct 15, 2025

Meme of the day provided by @kairo8080

And that’s it for this today.

See you all tomorrow’s edition!

Jonathan Gibson

UseTheBitcoin.com