- UseTheBitcoin.com Newsletter

- Posts

- Today's Top Crypto Headlines:

Today's Top Crypto Headlines:

Monero Faces Major Reorg | Yala Stablecoin Depegs | Treasury Narrative Splits and more...

Good Morning Crypto Enthusiasts!

Glad to have you back for another edition of the UseTheBitcoin.com newsletter.

Monero Faces Major Reorg: Monero’s blockchain suffered its largest-ever 18-block reorg, reversing 117 transactions and exposing vulnerabilities to 51% attacks.

Yala Stablecoin Depegs: Yala’s Bitcoin-backed stablecoin YU crashed to $0.20 after an attacker minted 120M tokens and dumped them across chains.

💡Feature of the Day - Treasury Narrative Splits: Nakamoto CEO David Bailey criticized firms for adding altcoins to their treasuries, warning it undermines Bitcoin’s role as a singular reserve asset.

All this and more in today’s headlines!

The back office, built for founders

We’ve worked with over 800 startups—from first-time founders at pre-seed to fast-moving teams raising Series A and beyond—and we’d love to help you navigate whatever’s next.

Here’s how we’re willing to help you:

Incorporating a new startup? We’ll take care of it—no legal fees, no delays.

Spending at scale? You’ll earn 3% cash back on every dollar spent with our cards.

Transferring $250K+? We’ll add $2,000 directly to your account.

📰 News Highlights:

Monero’s privacy coin XMR surged 7% despite suffering its largest-ever blockchain reorganization, an 18-block reorg reversing 117 transactions.

Nothing to see here. Qubic just pulled a casual 18 blocks reorg on Monero 🤷

— zuqka ױ (@AvdiuSazan)

7:36 AM • Sep 14, 2025

The attack, carried out by AI-focused mining pool Qubic, once again demonstrated the vulnerability of Monero’s network to 51% attacks.

Monero was hit by an 18 block reorg a few hours ago, which invalidated 118 transactions. This is the largest reorg in Monero's history. Unsurprisingly ***ic is looking for any way to stay relevant and to stop the bleeding of their dumping price.

— xenu (@xenumonero)

10:41 AM • Sep 14, 2025

This incident exceeded Monero’s existing safeguard of a 10-block lock, sparking concerns over its long-term reliability as a monetary system.

This is what looks like the 19 reorganization blocks in my monerod $XMR

— Ʊɬɱʘ 🏴 a³ ɱ ᕮ 𐤊 ױ א ⛛ (@Ulmonan0)

11:15 AM • Sep 14, 2025

Critics argue the repeated attacks undermine confidence in Monero’s decentralization-first design.

Monero is still suffering from the selfish mining attacks

An 18-block-deep reorg recently hit the chain.

Affected blocks were 3499659 → 3499676.

A massive amount of transactions were invalidated.Personally, I don't consider the Monero network reliable at this point. I'll stop

— Vini Barbosa (@vinibarbosabr)

12:23 PM • Sep 14, 2025

In response, the Monero community is debating drastic countermeasures, including adopting DNS checkpoints.

如果门罗币社区没人去认真对待区块重组之事,那这把达摩克利斯之剑就一直悬在门罗币头上…不一定会真的做双花攻击,但有这种能力了…也不一定非得严格超过 51% 算力…

— Cos(余弦)😶🌫️ (@evilcos)

10:08 AM • Sep 14, 2025

This approach would involve pulling trusted block data from centralized servers, potentially preventing reorgs but at the cost of decentralization—Monero’s defining principle.

🎁Freebie:

Download your free ebook now and take the first step toward mastering CRYPTO IN UNDER 60 MINS!

Yala’s Bitcoin-backed stablecoin, YU, has failed to recover its dollar peg after an attempted attack sent its value as low as $0.2046.

Our protocol recently experienced an attempted attack that briefly impacted YU’s peg. Thanks to the quick collaboration with @SlowMist_Team and our security partners, we’ve identified the issue and are already rolling out improvements to strengthen the system.

All user assets

— Yala (@yalaorg)

3:44 AM • Sep 14, 2025

An attacker exploited on-chain vulnerabilities to mint 120 million YU tokens, flooding markets by bridging them to Ethereum and Solana before selling for USDC.

Update: All funds are safe. Bitcoin deposited to Yala remains self-custodial or in vaults, with none lost.

We’ve identified issues and, as a precaution, paused some product features. Please wait for our green light before re-engaging.

A full post-mortem and action plan will

— Yala (@yalaorg)

9:35 AM • Sep 14, 2025

This oversupply collapsed YU’s peg, showing that even with strong Bitcoin collateral, flaws in minting and bridging mechanisms can cripple stability.

A hacker minted 120M $YU on Polygon and then sold 7.71M $YU for 7.7M $USDC on Ethereum and Solana via cross-chain.

The hacker still holds 22.29M $YU on Solana and Ethereum, with another 90M $YU still on Polygon that has not been bridged.

The hacker has now exchanged 7.7M $USDC

— Lookonchain (@lookonchain)

10:59 AM • Sep 14, 2025

While Yala’s team claims all collateral remains safe, confidence in YU has wavered, with the token now hovering around $0.78.

Update: All funds are safe. Bitcoin deposited to Yala remains self-custodial or in vaults, with none lost.

We’ve identified issues and, as a precaution, paused some product features. Please wait for our green light before re-engaging.

A full post-mortem and action plan will

— Yala (@yalaorg)

9:35 AM • Sep 14, 2025

The team disabled features like its “Convert” and “Bridge” tools to stop further abuse, but the broader issue underscores the fragility of algorithmic and collateralized model stablecoins.

Dear Yetis,

We want to keep you informed about a recent security incident at Yala. A breach resulted in the unauthorized transfer of funds; however, the situation is fully contained and under control. We have identified the stolen assets on-chain and are actively working with

— Yala (@yalaorg)

7:06 PM • Sep 14, 2025

💡 Feature of the Day:

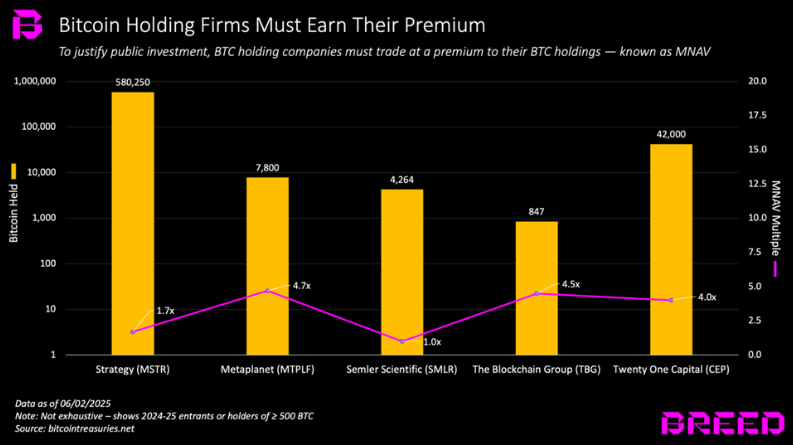

Nakamoto CEO David Bailey warned that the digital asset treasury narrative is being distorted by firms adding “failed altcoins” and “toxic financing” to their balance sheets.

The entire treasury sector is being tested, and rightfully so. Toxic financing, failed altcoins rebranded as DATs, too many failed companies with no plan or vision. It’s totally muddled the narrative. The treasury company moniker itself is confusing.

The bitcoin treasury company

— David Bailey🇵🇷 $1.0mm/btc is the floor (@DavidFBailey)

10:55 PM • Sep 13, 2025

Originally, the strategy focused on Bitcoin as a singular treasury asset—seen as decentralized, inflation-resistant, and a long-term store of value.

DAT Risk Framework

Saylor introduced the concept of "digital asset treasuries" (DATs) to companies like Microstrategy (now Strategy).

Many others copied his "leveraged crypto exposure" game plan.

Leverage works well in bull markets but poorly in bear markets.

If you're

— Doggfather (@DoggfatherCrew)

1:01 PM • Sep 13, 2025

However, more companies are diversifying into Ethereum, Solana, XRP, and even newer tokens, chasing short-term trends.

Calling it now—

In the next bear market, every (smart) altcoin treasury co will adopt a 10%+ BTC treasury allocation policy

For that is the natural order by Darwinism

— Jeff Park (@dgt10011)

12:53 PM • Aug 29, 2025

Bailey argues this shift dilutes the original Bitcoin treasury thesis and increases financial risk.

Analysts warn that poorly managed firms could enter a “death spiral,” where their stock trades below net asset value, forcing asset sales at a loss and further depressing their value.

😂 Crypto Meme of the Day:

Meme of the day provided by @cryptomemebot

And that’s it for this today.

See you all tomorrow’s edition!

Jonathan Gibson

UseTheBitcoin.com